Here in Kentucky, if you want to legally drive a motor vehicle, you will need some form of qualified car insurance. But before you choose a carrier, or file a claim if you already have one, be sure you know what to believe and what not to believe about automotive insurance. Continue below to learn the top 5 car insurance myths that people tend to fall for so that you may be a wiser driver and car owner from this point on.

Common Car Insurance Myths and Misconceptions

☒ Car Insurance is More Expensive for Red Cars

No, the color of your vehicle will not and should not have any influence over your carrier’s premiums. A red car is not more expensive to insure in comparison to vehicles of other colors. Factors that impact the total rate of your car insurance premium include the make and model of your vehicle, the body shape and engine size of your vehicle, as well as your age, driving record, and credit.

☒ Do Not Report an Accident to Avoid an Increasing Rate

Many people believe that if they simply neglect to report a car accident to their insurance company, it can prevent their car insurance rates from increasing. But this is not the case. First of all, if you are in a car accident with another driver, it is imminent that they will report to their own insurance company that will eventually notify your own.

Second, failing to report to your insurance company may have penalties that are decreed in your agreement, such as suspending or revoking your auto coverage. Regardless of what you do, rates are bound to increase for all sorts of reasons, and at the full discretion of your insurance carrier.

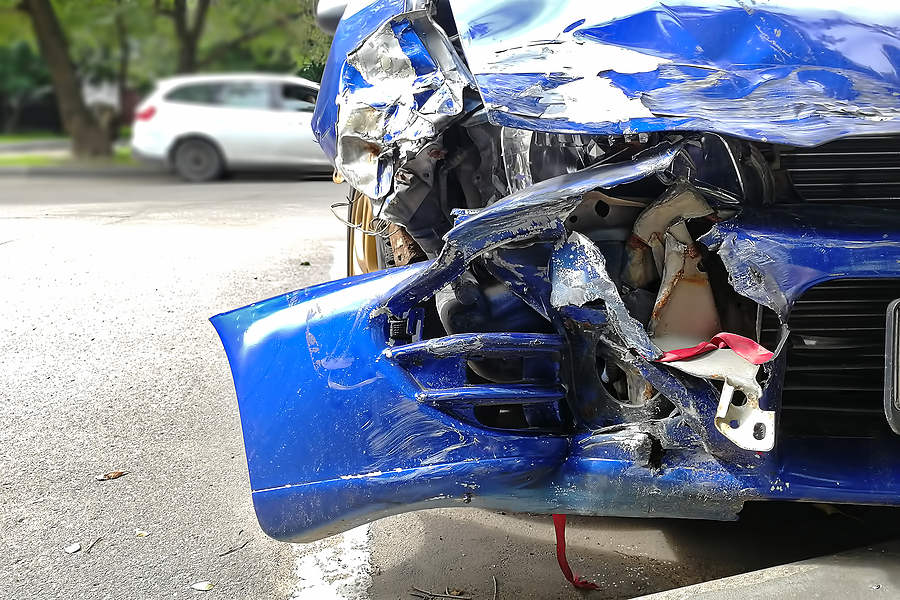

☒ Insurance Pays for Any Remaining Loan if the Car is Totaled

Anyone who believes this will eventually discover some devastating news once they report to their insurance company. Car insurance companies do not pay off loans on cars if they are totaled. Car owners are responsible for paying the remainder of any car loans, regardless of the vehicle’s condition or existence.

Car insurance companies will only pay out the current market value of a vehicle, or less depending on the type of auto coverage you pay for. Some policies do not pay market value, but rather, a percentage of it for totaled cars.

☒ Insurance Premiums Increase the Older You Get

Many people wrongly assume that car insurance gets more expensive as we age, but this is not necessarily true. If you continue to accrue a negative driving record with several infractions and offenses, then this could be true. But when it comes to mere age, there is no impact on the rate at which car insurance premiums increase, or the rate they are quoted at the time of inquiry.

☒ You Can Keep a Totaled Car and the Insurance Cash

As a claimant with full coverage, you will receive a payout for your totaled car’s current market value, minus depreciation. In some cases, insurance does not allow a claimant to keep a totaled car at all, and must physically surrender it to them prior to receiving a check. If you decide to keep your totaled car, you must notify your insurance company, who will then pay you a drastically reduced amount for it. Most often, it is at least 50% less, which is a significant deduction.

Did you total your car, but it is not covered under an insurance policy? Contact GC’s Junk Cars at 502-804-5605 to sell your car for cash on the spot to a trusted Louisville junk car buyer! We offer free junk car removal in all surrounding counties.

You Should Also Read:

Will Keeping My Totaled Car Reduce My Insurance Claim Payout?

The Most Expensive Auto Repairs That Can Total Your Car

What to Do After Totaling an Uninsured Car in Kentucky