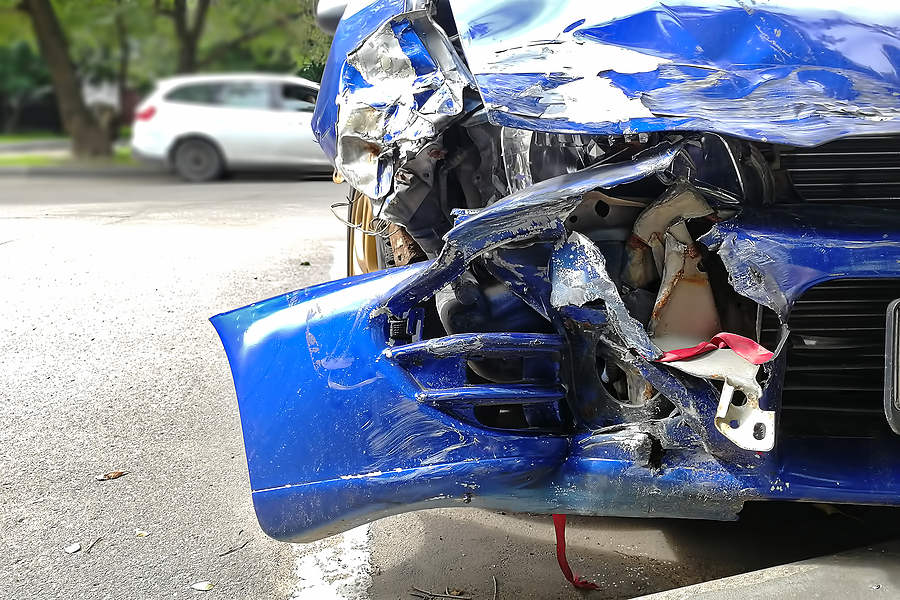

After totaling a car, your thoughts are likely all over the place. From medical attention and financial responsibilities, to time of work, kids, family, and more, the aftermath of wrecking a car can be quite overwhelming. But the one thing you should not have to concern yourself with is your automotive insurance claim. When you signed your policy, you agreed to a specific pecuniary procedure in the case that your car is deemed a total loss after an accident or damage.

So, when you are considering the possibility of keeping your car after you total it, your insurance carrier should already have a plan for that option. However, keep in mind that there could be some financial disadvantages to doing so. Furthermore, it might not be an option at all depending on your particular insurance policy limits and restrictions.

Continue reading to learn more about keeping a totaled car and what it could mean in terms of collecting a payout through an automotive insurance claim.

What You Need to Know About Car Insurance Claims and Total Loss Vehicles

In standard automotive insurance policies, if a claimant with full coverage wrecks their vehicle, the insurance company will provide payment to repair the damages. If the insurance company decides that a claimant’s car is totaled, they will officially deem it a total loss, which means the cost to repair the damages exceeds the current cash value of the vehicle. In this case, the claimant with full coverage will receive a payout for its value, minus depreciation. In some cases, an insurance policy does not allow a claimant to keep a totaled car at all, and must physically surrender it to them prior to receiving a check.

If you wish to keep your totaled car, the first question you might have is, “Will I get paid less for it?” The answer is an unequivocal and resounding yes. This makes sense, otherwise insurance companies would have to operate on an entirely different business model. How much less you get from your insurance company will depend on several factors, which you will have to read in the fine print of your policy. Most often, it is at least 50% less, which is a significant deduction.

Where to Sell a Totaled Car in Louisville, Kentucky

Call GC’s Junk Cars at 502-804-5605 to sell a junk car in Louisville and its surrounding counties, today! We accept all make and model vehicles, regardless of age or condition! There is never a middleman, which means you walk away with more cash in your pocket. Furthermore, we will dispose of your vehicle according to all Kentucky EPA regulations. You can rest assured that your car will not have a negative impact on our environment. We also offer free towing haul away!